This post may contain affiliate links. Please read my affiliate disclosure for more information.

No, you do not need an LLC to start dropshipping.

While an LLC is a popular legal structure for starting a business, you can also start dropshipping as a sole proprietorship.

Legal Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their attorney to obtain advice with respect to any particular legal matter.

What Is an LLC?

LLC stands for a limited liability company where the owners are not liable for the company’s debts or liabilities, according to Investopedia.

In short, it’s a lighter version of a corporation which makes it easier for small businesses to get started since forming a traditional corporation is a bit more difficult.

LLCs are great if you want something simple that adds some additional liability protection, professionalism, and a separate business bank account.

Do I Need an LLC To Start on Day One?

For those wondering if they need to get an LLC to get into the business and start on day one, the answer is no.

It’s up to you to make the decision if you want one.

This depends on how much liability you’re willing to take on, do you want a business checking account? or do you want to run it through your personal checking account?

Do you want to have an official name such as “Your Business LLC” versus a DBA (doing business as) which is tied to your personal assets? One of the primary reasons to get an LLC for your dropshipping business is liability protection.

For example, if you own a house and a car, if something goes wrong with your business, do you want that house and car potentially in reach for a lawsuit if someone sues you?

If you don’t have that much liability, then running it through your personal account as a DBA does work.

However, there are cases where people can pierce the corporate veil, which may defeat the purpose of the LLC in the first place. Having an LLC is by no means a silver bullet depending on how you structure your business. The liability protection of an LLC only applies to a certain extent.

Negligence as an LLC

In the legal world, negligence is always something to keep in mind and consider.

According to Cornell, negligence is defined as a failure to behave with the level of care that someone of ordinary prudence would have exercised under the same circumstances. The behavior usually consists of actions, but can also consist of omissions when there is some duty to act (e.g., a duty to help victims of one’s previous conduct).

If you do something negligent in your LLC, that would not be covered. For example, if you’re aware that a staircase in your warehouse is faulty and you tell people to walk down it and if someone were to fall or injure themselves, then you’re not protected.

In a nutshell, you can’t just do whatever you want because you have an LLC.

LLC Alternatives

Other than an LLC, there are alternatives for the type of business entity you can choose. While LLCs are simpler to form than the corporation options, you can migrate them over for tax purposes such as an LLC to S-Corp.

- Sole Proprietorship

- S-Corp

- C-Corp

How Much Does an LLC Cost?

The cost of an LLC also varies by the state which includes your initial filing fee and an annual or biennial fee. This ranges from $40 to $500, with an average LLC cost of $132.

Each state has its own process in how they file and store business entities, as well as the LLC average turnaround time.

Can You Get an LLC From Another State or Living Abroad?

If you’re living abroad or running your eCommerce store from another state or country, can you still register an LLC?

The answer is yes.

For example, if you operate your store in the “nomadic” lifestyle from Thailand or Vietnam and you’re from the United States, then you can get set up from anywhere in the world.

There are many US citizens living abroad, ex-pats, or even internationals without an affiliation to the United States that can register as an LLC within a specific state in the US.

As a United States Citizen

If you’re a US citizen living in the states, traveling, or living elsewhere, and you have a US checking account then you’re in the clear.

As an International

For internationals wanting to open an LLC in the United States, the difficulty is opening a business checking account. If you have an existing relationship with a bank, then it can make the process much easier.

However, if you don’t live in the United States or have never been to the United States, then your options are limited. Banks need to be able to identify clients.

Here a few ways to get a business bank account for your LLC:

- Friend or family member in the US

- Travel to the United States

- Partner with a US citizen

If you have no way to open a US bank account as an international, you can operate your finances through your country’s local banks to get started with your business, receive payments from customers, and pay suppliers for products.

One LLC for Your Business or One for Each Dropshipping Store?

It’s common for many people running a dropshipping business to have more than one eCommerce store. The question is, should you have just one LLC for the entire business or one for each dropshipping store?

Selecting which is better comes down to personal choice.

Do you want liability protection for each individual business? Is it a low-risk business where you can have one entity to run all the different businesses?

For example, if you own one high-risk store, then it may be best to form individual LLCs to protect your other assets.

Ultimately you don’t want one store dragging down two or three others. If there’s one that presents a higher risk, then you may want to isolate it from the others as its own LLC.

Another reason to open an individual LLC for each store is if you’re building up a few dropshipping stores to sell. This way, you can make the selling and migration process much easier and frictionless.

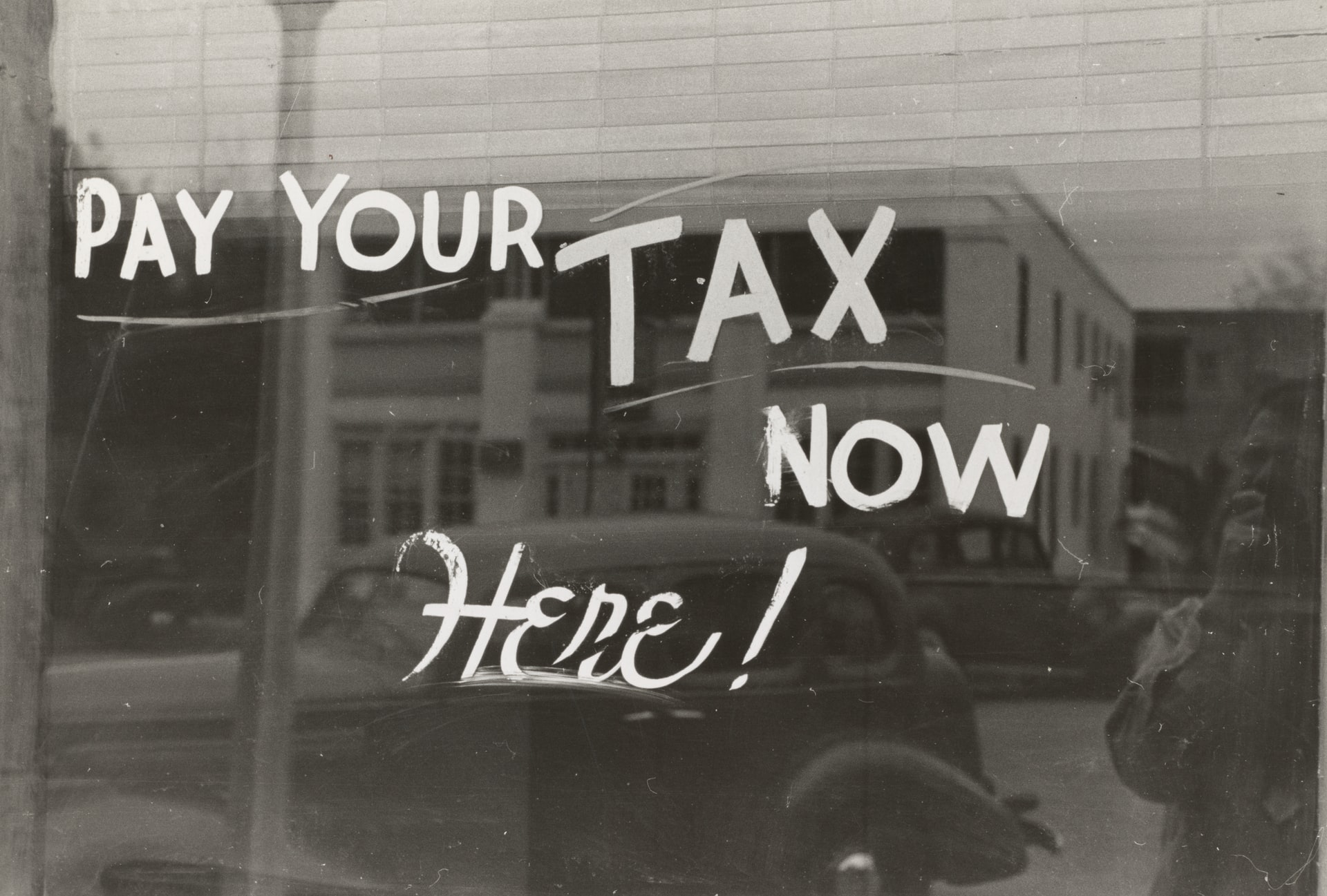

Taxes and Finance

When it comes to taxes and finance, creating an LLC and a separate business bank account can help to make your accounting process easier. It’s one of the main reasons to form an LLC for dropshipping.

While not necessary, a separate account for business use only outlines your income and expenses much more clearly. Monitoring your bookkeeping month to month and year over year can also help you run your business better.

This way you know your numbers, and can separate business from personal. This also helps people who may have issues with commingling funds.

EIN vs SSN for Dropshipping Business Banking

When opening a bank account for your dropshipping business, you can choose to open it under an LLC with your EIN number. An EIN stands for Employer Identification Number and is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States for the purposes of identification, according to Wikipedia.

Alternatively, if you prefer to keep everything under a sole proprietorship, you don’t need anything special than your social security number and you can use your personal bank account. Or you could even open another checking account with a different bank under your SSN and only use that account for business purposes.

While doing it this way wouldn’t necessarily provide you with the same liability protection, it would effectively do the same for accounting purposes.

Either way, as long as you have access to opening a bank account to receive payments from customers and pay suppliers for products, you’re able to start dropshipping.

Establishing Dropshipping Business Credit

Establishing business credit for dropshipping is another reason why you may want to file for an LLC. By having a separate bank account opened under your business, this also gives you access and opens the door for banks to offer you business credit cards.

Banks will also offer you business credit cards as a sole proprietor. However, the SBA explains there is no legal or financial separation in that case.

According to Accion, banks will use your personal credit as a way to act as verification for your business credit accounts initially. Over time, you can establish your business credit separate from your personal credit.

To Conclude

Many people get hung up on the idea that they need to make sure everything is perfect before they get started with their business.

A common excuse is that they need their business as an LLC before they get started. Whereas in reality, they could hit the ground running as a sole proprietor, and then register as an LLC later down the road if you desire.